Creating an Early Retirement Plan: Essential Steps for a Secure Financial Future

Disclosure: Some of the links on this website are affiliate links, which means that I may earn a commission if you click on the link or make a purchase using the link. When you make a purchase, the price you pay will be the same whether you use the affiliate link or go directly to the vendor’s website using a non-affiliate link. By using the affiliate links, you are helping support the website, and I genuinely appreciate your support. Also, as an Amazon Associate, we earn from qualifying purchases. This page contains affiliate links. If you choose to purchase after clicking a link, we may receive a commission at no extra cost to you.

Early Retirement

With the right planning and preparation, you can create a secure financial future for yourself with an early retirement plan. Retirement planning is an important step in financial planning, and it’s important to understand the different steps involved in creating an early retirement plan. This blog post will discuss the essential steps for creating an early retirement plan, including calculating your FIRE number, setting financial goals, assessing your current financial status, and maximizing tax benefits.

What is an Early Retirement Plan?

An early retirement plan is a financial strategy for individuals who want to retire before the traditional retirement age of 65. This plan involves taking steps to ensure that you have enough money saved to cover your expenses and live comfortably in retirement. Early retirement plans typically involve making smart investments and taking advantage of tax benefits in order to maximize your savings. There are various types of early retirement plans, including 401(k) plans, Roth IRA’s, and taxable accounts. Each of these plans has different rules and regulations, so it’s important to do your research and understand the differences between them before you decide which plan is right for you.

Benefits of an Early Retirement Plan

Creating an early retirement plan can be a great way to ensure a secure financial future. With an early retirement plan, you can take advantage of tax benefits and make smart investments that will give you more money to live off of in retirement. Additionally, an early retirement plan can allow you to retire earlier than the traditional retirement age and enjoy more time doing the things you love. Another benefit of an early retirement plan is that you can be financially independent and not have to rely on Social Security or a pension plan to cover your retirement expenses. This gives you more freedom to make decisions about your retirement without having to worry about the financial implications.

Calculate Your FIRE Number

One of the first steps in creating an early retirement plan is to calculate your FIRE number. FIRE stands for “financial independence, retire early.” To calculate your FIRE number, you need to add up your monthly expenses and multiply them by 25. This number is the amount of money you need to save in order to retire early. It’s important to be realistic when calculating your FIRE number. You need to factor in inflation, unexpected expenses, and any other costs that may arise in retirement. Additionally, you should factor in any Social Security or pension benefits you may receive. This will give you an accurate picture of how much you need to save in order to achieve financial independence.

What is the Best Retirement Age?

The best retirement age depends on your individual circumstances and goals. Generally, most people should aim to retire around the age of 65, as this is when most people receive Social Security benefits. However, if you have saved up enough money to cover your expenses, you may be able to retire earlier than the traditional age. It’s important to understand that retiring early can have its advantages and disadvantages. On one hand, it can allow you to enjoy more time doing the things you love. On the other hand, it can mean sacrificing certain things, such as Social Security benefits, that you would otherwise receive if you waited to retire until the traditional age.

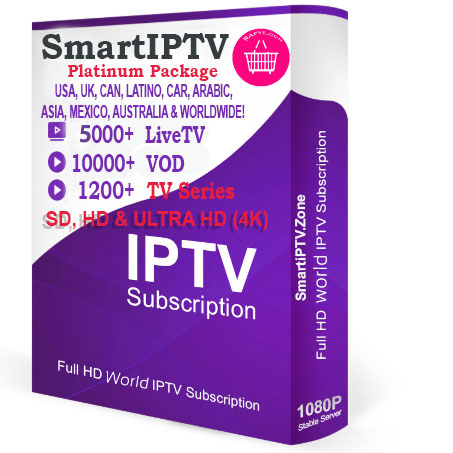

Watch streaming live TV services, Video on Demand and TV Series. A better and cheaper alternative to Satellite, Cable TV, NetFlix, Hulu & others. Visit www.cenadirect.shop

Early Retirement Plan Video

Steps for Creating an Early Retirement Plan

Creating an early retirement plan involves understanding your financial situation, setting realistic goals, and taking the necessary steps to achieve them. Here are the essential steps for creating an early retirement plan:

Establishing Financial Goals

The first step to creating an early retirement plan is to establish your financial goals. This involves assessing your current financial situation and determining what you want to achieve with your early retirement plan. Do you want to retire early and travel? Would you like to retire early and stay at home? How about retiring early to start a business? Once you have established your financial goals, you can create a timeline for achieving them. This timeline should include specific goals and milestones that you want to achieve in order to reach your ultimate goal.

Setting Realistic Timelines

Once you have established your financial goals, you need to set realistic timelines for achieving them. This involves setting short-term and long-term goals that are achievable and measurable. It’s important to be realistic with your timelines and to factor in any potential obstacles that may arise. In addition to setting realistic timelines, it’s also important to keep track of your progress. This will help you stay on track and ensure that you are making progress towards your financial goals.

Assessing Your Current Financial Status

The next step in creating an early retirement plan is to assess your current financial status. This involves understanding your current income, expenses, savings, and investments. You should also take into account any debt you may have, such as student loans or credit card debt. By understanding your current financial status, you can get an accurate picture of your financial situation and create a plan for achieving your financial goals.

Maximizing Tax Benefits

When creating an early retirement plan, it’s important to take advantage of any tax benefits that you may be eligible for. These benefits can include deductions, credits, and incentives that can help you save money and lower your tax bill. Some of the most common tax benefits for early retirement include Roth IRA contributions, 401(k) contributions, and the Saver’s Credit. It’s important to research these tax benefits and understand how they can help you save money in the long run.

Strategies for Saving Money

Another important step in creating an early retirement plan is to develop strategies for saving money. This involves understanding your spending habits and identifying areas where you can cut costs. Some strategies for saving money include creating a budget, tracking your spending, and setting up automatic transfers into a savings account. Additionally, you should consider ways to increase your income, such as taking on a side hustle or finding ways to make your money work for you.

Investing for Retirement

Once you have established your financial goals and developed strategies for saving money, you need to start investing for retirement. Investing for retirement can be a great way to ensure a secure financial future. When investing for retirement, it’s important to diversify your investments and understand the risks involved. You should also research different investment strategies and decide which ones are right for you. Additionally, you should consider setting up automatic investments so that you can save money without having to think about it.

Reviewing and Revising Your Retirement Plan

Finally, it’s important to review and revise your early retirement plan on a regular basis. This will ensure that your plan is still in line with your financial goals and that you are taking the necessary steps to achieve them. It’s also important to understand that your financial goals and circumstances may change over time, so it’s important to review and revise your plan accordingly. This will help ensure that you are on track to achieving your financial goals and that you are taking the necessary steps to ensure a secure financial future.

Conclusion

Creating an early retirement plan is an important step in financial planning and can help you achieve a secure financial future. An early retirement plan can provide you with the freedom and flexibility to enjoy more time doing the things you love. It’s important to understand the different steps involved in creating an early retirement plan, including calculating your FIRE number, setting realistic timelines, assessing your current financial status, and maximizing tax benefits. By following these steps, you can create a secure financial future for yourself with an early retirement plan.